|

As announced by HCL with the release of BigFix 11, support (across all BigFix Platform components including Root Server, Relay, Client, Console, Web Reports) for version 9.5 will end. Users are encouraged to upgrade to either version 10 or 11 (free under S&S subscriptions) or face potential extended support costs if still running 9.5. As a result, IBM have also announced that their License Metric Tool (ILMT) will withdraw support for BigFix server and clients in version 9.5 at the end of Q4 2024. While it doesn't mean that you'll be ineligible for PVU subcapacity, it does mean that you won't receive support from IBM if your environment stops working correctly, and no doubt prove increasingly problematic in various ways. So while its 9 months away its best to get the upgrade onto your plans now, as that time will all too easily disappear leaving you with a budget shortfall to cover what is typically hefty extended support fees!

0 Comments

Tucked away (as usual) outside the summary of updates is clause 4.1 - License Verification and to a lesser extent 10.2 - Client's Reporting Responsibilities (applicable to sub-capacity licensing), which compound compliance and reporting obligations - lets take a look. Firstly, clause 4.1.(a) states the "Client will, for all Programs at all Sites and for all environments, create, retain, and each year provide to IBM upon request with 30 days' advance notice: i) a report of deployed Programs, in a format requested by IBM, using records, system tools output, and other system information; and ii) supporting documentation (collectively, Deployment Data)". Unlike version 10 of the PA Agreement (November 2017) which contained a much more lenient requirement that "Client agrees to create, retain, and provide to IBM and its auditors accurate written records, system tool outputs, and other system information" which would occur simply "on reasonable notice" rather than a regular, annual basis. Adding to this, where running under sub-capacity licensing as before you are then required to "properly install, run, and maintain the most current version of the applicable license reporting tool within 90 days of Client's first deployment and produce a report. Unless IBM approves a different reporting tool, the Client agrees to the following tools.

Ok, no real change there and easy enough right? Well yes, you're still required to run and keep reports at minimum quarterly and retain for a two year rolling period - and remember to have an individual(s) who is assigned the "authority to manage and promptly resolve questions on reports or inconsistencies between report contents, license entitlement, and the applicable license reporting tool". Better check that's been added to the appropriate JD's along the way. The new clause 10.2.(e), is somewhat favorable to the client in that it provides an avenue to address (with IBMs consent) deviations from the sub-capacity model, which in most cases would probably result from operating systems becoming non-eligible over time. What we (and others) have always attested to though is being solely reliant on one reporting tool, like ILMT, can prove very problematic in that where improperly configured you could easily be over-reporting and paying much more than you should - having an independent product (like ComplianceWare) is often the best - or only - way to reconcile outputs and ensure accuracy. so ... when does all this start?Well, basically now:

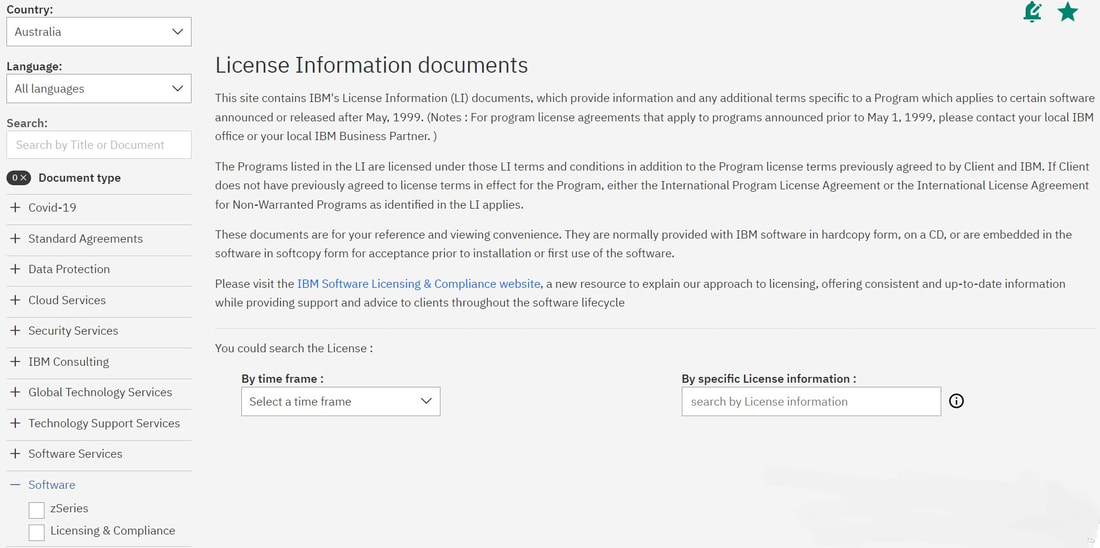

A slick new consolidated (and overdue) look for all IBM terms from one convenient site.

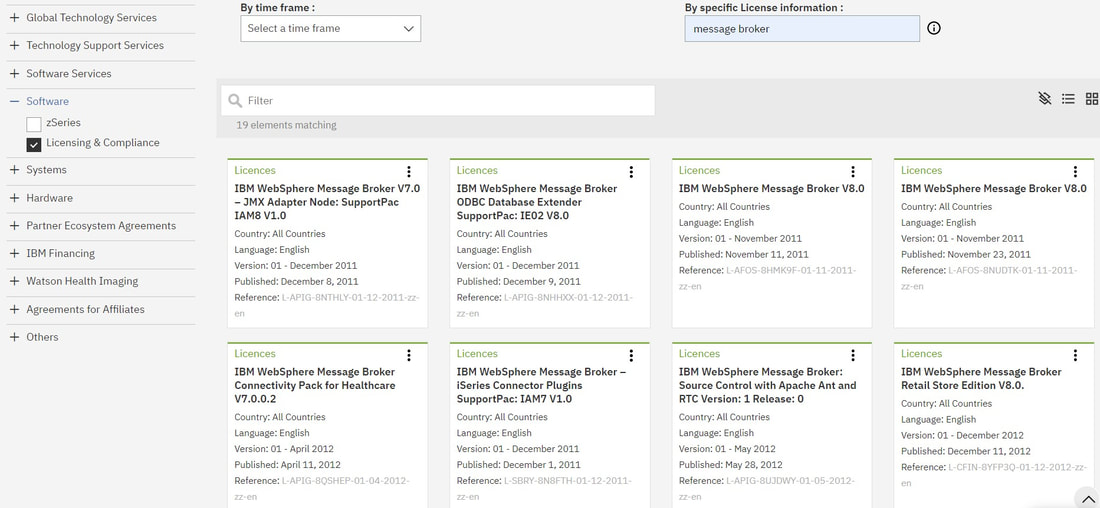

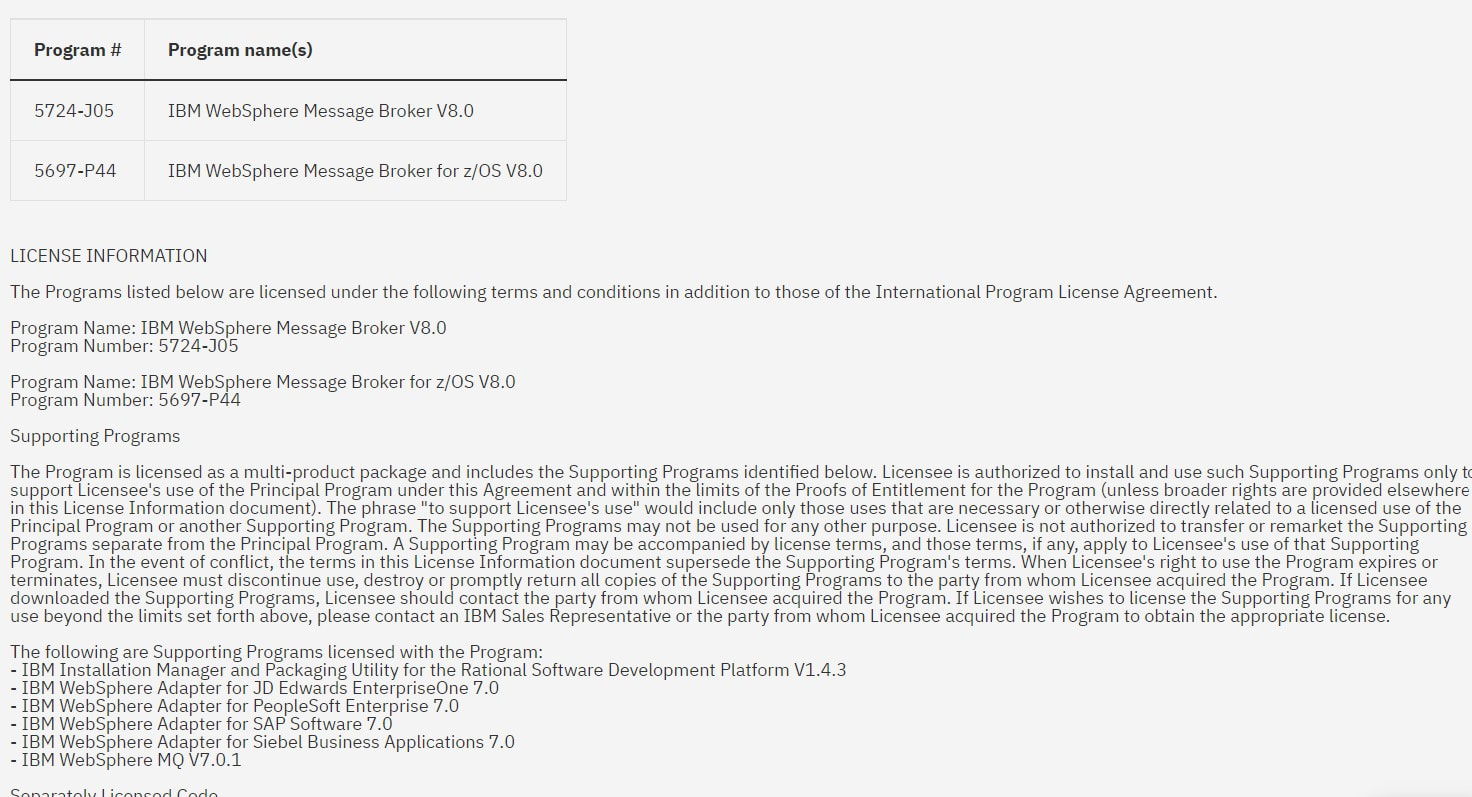

The Software license terms (all post May 1999) are searchable via the 'Licensing & Compliance' filter category, by time frame or license information (Program name/number, document form/part number, License Information (LI) number or License Information (LI) title): So nothing new or revolutionary on that front, however the ease of use and in particular the layout, share, download, and notification options provide all of the basic /requisite features you'll need - all in all, a welcome step forward from the IBM licensing team!

If you rely on IBM Sub-Capacity licensing its a good idea to check you are meeting the compliance requirements on a regular basis ...You no doubt recall that IBM divested the BigFix portfolio of products to HCL in 2019, however maintained ILMT (which remains based on BigFix Inventory), as their free license measurement tool that can be used to meet the reporting and validation requirements under the sub-capacity rules. There is no escaping the sub-capacity rules - as IBM states: "the use of ILMT is recommended for Full Capacity PVU environments, and is mandatory for use with PVU sub-capacity licensing". There are some exceptions to this requirement, essentially though, its only where you measure everything at Full Capacity. So a quick recap of the base requirements for sub-capacity licensing:

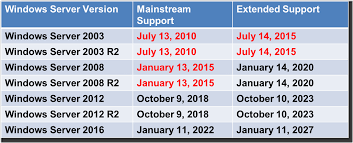

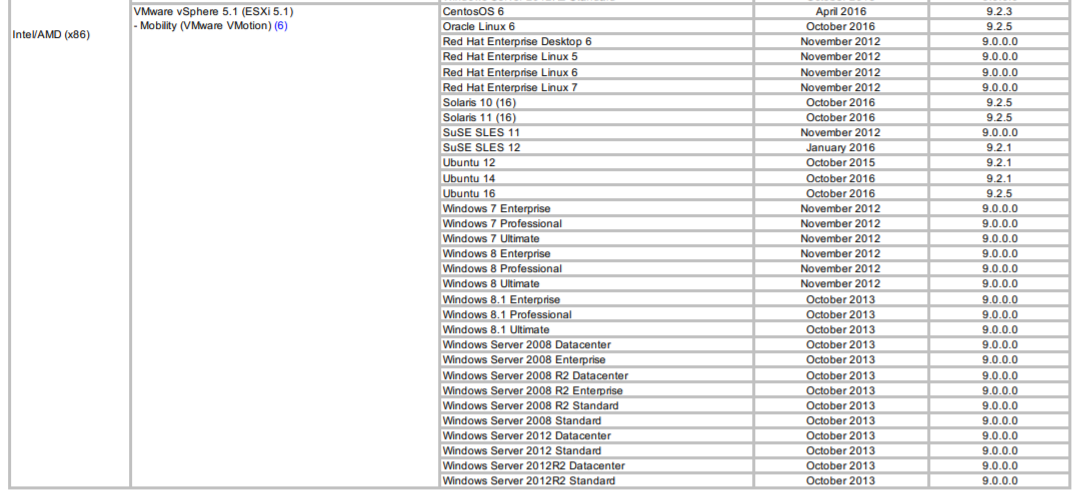

The other validated tools? Only Flexera One with IBM Observability IT Asset Management and Flexera One IT Asset Management at this time. Now there are some 'tricks and traps' in running ILMT that we reported on back in 2020 (refer blog here), so make sure you're aware of and managing those gotcha's, and then you'll need to ensure that your IT team is across the eligible technology requirements - most notably - 'Eligible Operating Systems'. These are regularly updated - with only 180 days notice of any withdrawal - so you might find yourselves exposed to the untenable position of being denied sub-capacity licensing based on the OS you're running - as an example, the earliest eligible version of Windows Server is now 2012 ! It can be very easy to lose sight of these changing conditions, and doing so at best can be very problematic, at worst very expensive, so make sure keeping current is diarized in your (and the relevant IT teams) calendars. Further, ILMT itself will need roles assigned to maintaining versions and your software catalogue, and also meeting the quarterly reporting requirements. Keep in mind ILMT retains historic data, so any late changes might well be contested under audit, so better to keep on top of your situation on an ongoing basis. ... all good reasons to perform a timely health-check across your IBM sub-capacity licensing.Hats Off to IBM for it's new dedicated Licensing and Compliance site.Launched on the 17th February the site is a comprehensive, easily navigated resource for both SAM beginners and experienced personnel alike. Quoting Wes Mantle from the Licensing and Software Sales division: "We hope our Licensing & Compliance website will be a go-to resource for IT executives and SAM/license managers, providing clear guidance for measuring deployment effectiveness and navigating software verification process in an efficient, fair and timely manner."The 'Licensing' section offers a good starting point with links to related subjects and material, and also provides particularly good graphical representations of IBM's many agreement structures along with key terms and clauses, while the 'Measurement' section covers the array of metrics and topics across on-premise, cloud and mainframe platforms. If short on time, on everyone's list should be a read and review of the new licensing Guides that include:

The guides have been re-written in a much more readable and informative style covering all fundamental licensing subjects including the often misunderstood virtualization, backup and recovery, and non-production environment rules and obligations. Of course the site wouldn't be complete without covering IBM's Verification approach, which includes audits, self-declarations and the IASP program. Interestingly, the section doesn't make reference to IBM's new, hosted, software management tool ESMT. The Enterprise Software Management Tool is described as an enhancement over the functionality currently provided by PA Online, providing "a full software inventory which details the number of licenses currently deployed and the number of licenses available to deploy. This can be updated in real-time to reflect any changes in requirement, meaning you always have a contemporaneous view of your IBM license position". What's not clear is how the tool will actually operate in order to provide the view of "how many licenses have been used, where and by whom". This seems to imply some degree of discovery across the client landscape - on an ongoing real-time basis - which would come with its own complexities and certainly, concerns. We'd be keen to hear from anyone who has or is looking to adopt this approach - please comment below or get in touch! What's not raised cynical eyebrows though is IBM's view of the benefits of being in compliance:

... we can all agree on that! So set aside some reading time and work your way through the site - it will be a valuable use of time, and ensure you bookmark it as you'll no doubt have cause to return on numerous occasions!

Vendor results can be a telling indicator of what might lie aheadWe regularly connect with the ITAM Review as a reliable source of information in the software domain and of interest this month is a comprehensive report from Rich Gibbons on the financial performance of some key software vendors - from the $5.6B loss of Google Cloud to the 29% rise in operating income (Q2) of Microsoft. In summary ...

Some marked differences in performance - particularly in the cloud space, with a watch and ready advice for some of the poorer performers - we all know where they head when times are tight ...

An innocuous Announcement Letter may be more telling than it seems ...

While discounts will remain for hybrid and cloud platforms, as of 1st July these will no longer apply to your on-premise installations. With statements such as: "where we will continue to focus our investment and innovation" And ... "it is recommended that your company evaluate and plan a transition to the equivalent, cloud- and/or hybrid cloud-based offering" The message seems pretty clear that the future as IBM sees it is all in the Cloud, certainly if you're looking for discounts on your next purchase of PA software. It will be interesting to see what might follow in IBM's plans to further 'encourage' cloud migration, and how others might adopt similar strategies.

All might not be as it seems - check this list of ILMT gotcha's

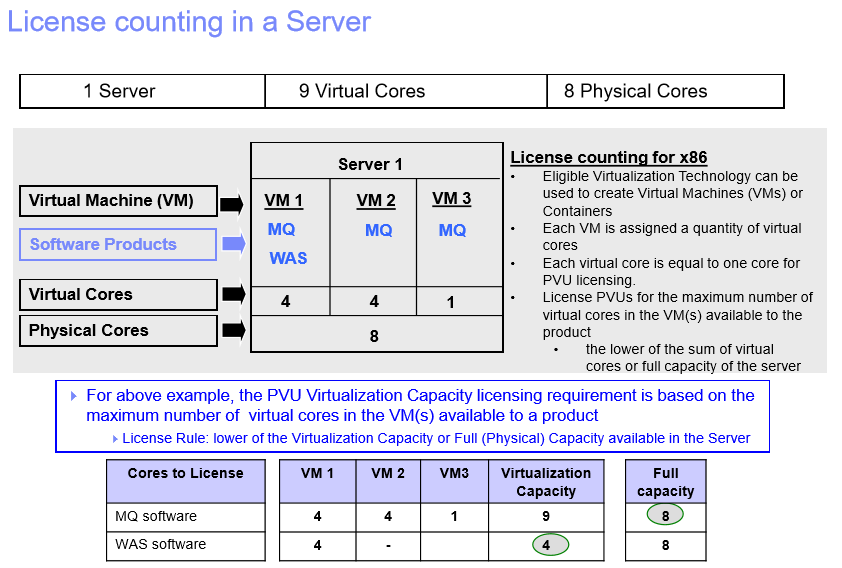

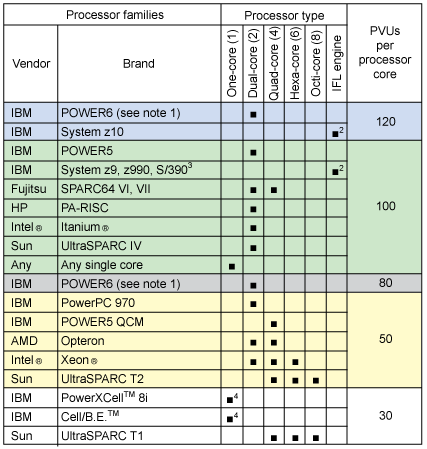

Here are out top five tips for trimming your PVU sub-capacity report counts: 1. Incomplete Vitualisation - the 'TVM' predicamentIf your ILMT configuration is not fully or properly implemented you're likely to find incomplete virtualisation heirarchies in your VM Manager connections, which result in every affected VM being treated as a stand-alone physical machine at the highest PVU rating of 120 PVUs per core). This can quickly add up where you might otherwise be entitled to the likes of 70 PVUs per core. 2. Missing Software ClassificationsCentral to the accuracy of ILMT reporting is the much dreaded 'Software Classification' process. If you choose to ignore this painstaking requirement you can be sure you'll pay the price either in real terms or in time-draining dispute at your next audit. Essentially, every exempt PVU count in your environment needs to be catagorised as such, meaning instances that are to be excluded from PVU counts (which depending on the License Terms are likely Developer, DR, or Test installs) need to be individually identified as such via this (ongoing) activity. 3. Unrecognised BundlingAs a follow-on to the Software Classification issue above, you'll then likely notice that where you have installed Supporting Programs on a different server - where entitled to do so under the License Terms - the program will magically form part of the PVU count, ie. bundling is not recognised across servers. So once again you'll need to identify these instances and exclude them from the relevant count, making sure you add comments to qualify the classification. 4. Reallocation High-Water MarksSo you dutifully maintain your vCPU's to your level of entitlement, which, as you're permitted to do, includes the occasional reallocation across servers to match processing and performance needs. Given you've balanced the core counts out all is good - right? Well ... no, ILMT will track the high-water mark for each server in the 90-day reporting period, so for example a taking a core from a 4 vCPU server to assign to a 3 vCPU server will see both reporting as 4 vCPU servers for that period. To be in a position to challenge this make sure you have or take - and keep - separate records that evidence the reassignment of cores to negate any double counting. 5. Ghost DecommissioningSimilar to the above, you might think that decommissioning one server to deploy another would be quite within your rights as long as you (as always) don't exceed your level of entitlements. Well ... no, the decommissioned server will also report within the same 90-day period as the new server - potentially a bigger problem than the issue with high-water marks. So again you'll need to either classify the server accordingly, or ensure you have the right artefacts to contest any double recognition, or both. ... a lot of overhead right?Yes.And that's where a secondary source of truth can prove essential ...IBM Announces its new "Authorised SAM Provider" Offering (IASP)While it appears the disgruntled messaging from clients is finally starting to register with some major vendors, a recent announcement from IBM (outlined here by the ITAM Review) by no means makes it an all clear. We're all for any move to make software licensing compliance simpler, and the IASP program for some large IBM customers might just do that - although by invitation only and accomplished by engaging one of just four designated IBM partners:

OKAY, SO WHAT's THE OBJECTIVE?In a nutshell, to offer those select few an alternative to IBM's License Reviews by operating a managed service that brings SAM expertise, tools, and knowledge to organisations who are perhaps struggling with those skills themselves - which happens to be exactly what we at Software Compliance have been offering our valued clients since 2016! HOW ABOUT the APPROACH?Once invited, an organisation selects an authorised partner who will then - through a defined scope of paid work - follow the standard licensing compliance process to create a baseline (using ILMT), perform an initial reconciliation, resolve any issues, and implement an ongoing management and control program, all done under an IASP Agreement that must be executed with IBM (covering a term of up to 3 years). ... And THE Benefits?The major attraction is that any licensing shortfalls discovered in the initial baseline can be resolved at the customers entitled price without any back-dating of S&S - and - an apparent waiver of any sub-capacity issues (tbc). ... and we all know how problematic (ie. costly) issues in this space can be! On the surface perhaps an admirable new direction from IBM, but does it really differ to how customers operating under the likes of an Enterprise Services & Software Offering (ESSO) have been treated for the last 10+ years? We think not - baselines were created, shortfalls resolved (albeit perhaps not as transparently), regular reporting was mandatory, etc ... so the only difference seems to be that the customer is required to engage one of just four designated partners.

Contact Us ... (before your Vendors do)

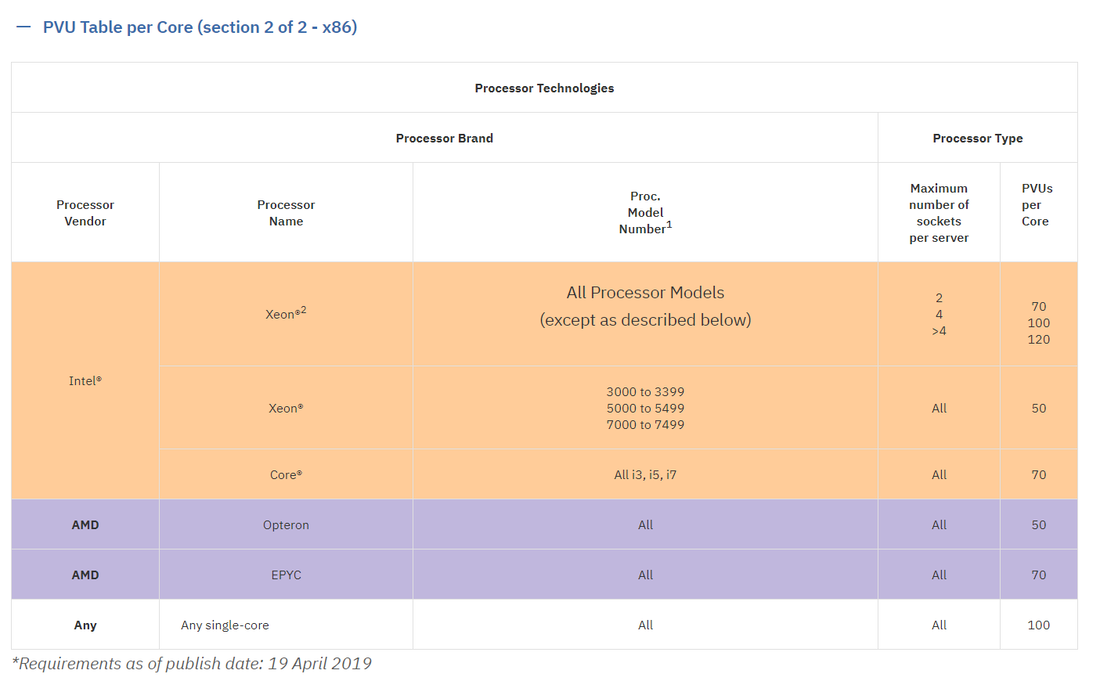

Could the Change to IBM's PVU Core Table Signal a Refreshing SHIFT in Sub-Capacity Licensing? While some vendors prefer to wallow in the mire of antiquated and irrelevant licensing regimes others seem to be moving ahead with revised models that provide clarity and ease in establishing your licensing and compliance position. A case in point - IBM - who flagged a rethink with a shift from the messy PVU to Virtual Processor Core metrics (example in the hyperlink). Starting April this year the x86 PVU Table has been culled down to just 6 entries with the Intel category now much simplified for the Xeon chipset, basically all determined by the number of sockets at 2, 4, and >4 (with the lower models in the listed ranges remaining at 50 PVU's): There is however one complication - Symmetric Multiprocessing Servers - which you need to factor per definition below: The PVU requirement for the Intel processor technology indicated is dependent on the maximum number of sockets on the server. If sockets on two or more servers are connected to form a Symmetric Multiprocessing (SMP) Server, the maximum number of sockets per server increases. Example:

Good news from our perspective - anything that removes ambiguity is welcomed (with reference to the linked post at the start of this blog: "oh but you have to count the Physical cores, not virtual, on the Host, in fact all Hosts in the complex, actually in the Data Center, well let's say the Cloud then, so basically ... ... everything, everywhere")

Extended Support for SQL Server 2008 and 2008 R2 will end on July 9, 2019. |

<

>

Archives

November 2023

|

|

Unravelling license complexity for Business

ACN 623 529 751 |

Privacy Policy | Terms of Use

|