|

The GAO analyzed six randomly selected Department of Defense (DOD) programmes based on fiscal year 2023 budget size and grouped the investments into three groups — greater than $100 million, between $100 million and $10 million, and between $10 million and $1 million, with key findings that vendors:

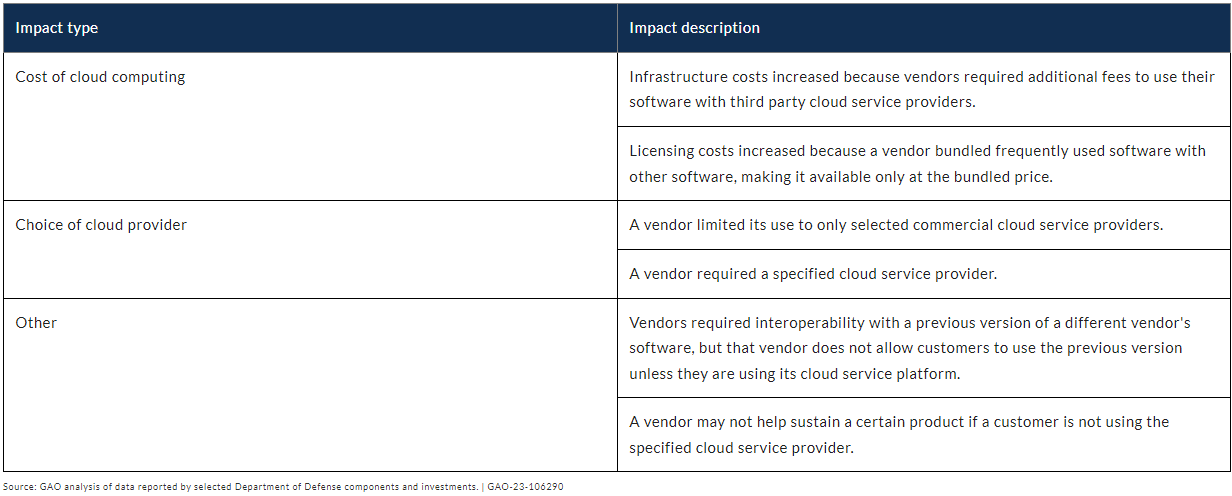

Not a good story, although no doubt a common one that, given CIO's and CTO's relentless push to the cloud in recent times, (fully endorsed by doe-eyed executive committees and boards clambering to chat that 'yes, we're doing that too') are unlikely to get air time in that respect - just glowing reports of progress and ever increasing (perhaps slowly) 'number of migrated applications' statistics. Now we're not saying there is no place for the cloud - there is - but per the recommendations of the GAO from this report, it needs to be formulated through guidance and plans that fully address identifying, analyzing, and mitigating the impacts of restrictive software licensing practices on cloud computing efforts. And therein is the problem. Many CIO's and CTO's would rather rely on vendors or consultants recommendations rather than their own in-house expertise across IT, SAM and procurement teams who know in detail what - and where - costs and impacts are likely to arise. So if nothing else, perhaps try to use the GAO's Examples of Reported Restrictive Software License Practices table below as a minimum checklist of what to consider with your next cloud migration programme - it might bring some future issues to light and maybe even save just a little grief!

0 Comments

Although it's easy to overlook regular reviews of your development environments - it's still necessary.

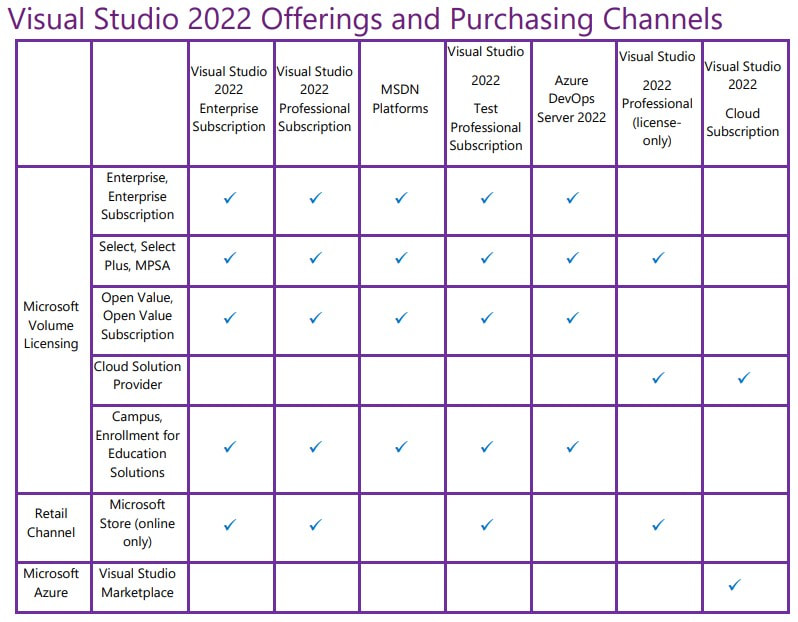

Focusing on the 2022 edition of Visual Studio, the guide complements the standard Product Terms and/or the EULA for retail and community versions, with the Visual Studio License Directory also a good reference site covering all things related to Visual Studio, including prior versions. Firstly, aside to the Community Edition (being the free, full-featured IDE for individual developers and small organizations with 5 or less developers, and for education and open source software), what are the available options: The licensing fundamental with all Visual Studio subscriptions and Visual Studio Professional is that they are licensed on a per-user basis, meaning each licensed user may install and use the software on any number of devices to design, develop, test, and demonstrate their programs. Visual Studio subscriptions also allow the licensed user to evaluate the software and to simulate customer environments to diagnose issues related to your programs. Importantly, each additional person who uses the software in this way must also have a license. You'll also need to consider the environments in which Visual Studio can run, as although the licensed user can install multiple versions on multiple devices, it cannot be used in a production environment or environments that constitute production environments such as:

So keeping in mind these two base conditions - ie. everyone who uses the software (with some exceptions such as acceptance tests) must have a license, and use is limited to certain environments - review the paper for guidance specific to your situation and ensure you are compliant, as remedial costs attached to any breach can be very (and that is Very) costly.

Published on their Customer Support website HCL have advised that charges across renewals and the full software catalogue price list are increasing by a hefty 15%, which is likely to burden already stretched IT budgets. And while the impacts of this jump are fully considered, keep a lookout for similar announcements from other software vendors - these announcements tend to come in waves. So best get prepared for your upcoming renewals with those arguable positions, concessions, additions or any available means to minimize your uplifts, along with the inevitable explanations to those in your organization who believe (others) costs should only go down, never up!

Tucked away (as usual) outside the summary of updates is clause 4.1 - License Verification and to a lesser extent 10.2 - Client's Reporting Responsibilities (applicable to sub-capacity licensing), which compound compliance and reporting obligations - lets take a look. Firstly, clause 4.1.(a) states the "Client will, for all Programs at all Sites and for all environments, create, retain, and each year provide to IBM upon request with 30 days' advance notice: i) a report of deployed Programs, in a format requested by IBM, using records, system tools output, and other system information; and ii) supporting documentation (collectively, Deployment Data)". Unlike version 10 of the PA Agreement (November 2017) which contained a much more lenient requirement that "Client agrees to create, retain, and provide to IBM and its auditors accurate written records, system tool outputs, and other system information" which would occur simply "on reasonable notice" rather than a regular, annual basis. Adding to this, where running under sub-capacity licensing as before you are then required to "properly install, run, and maintain the most current version of the applicable license reporting tool within 90 days of Client's first deployment and produce a report. Unless IBM approves a different reporting tool, the Client agrees to the following tools.

Ok, no real change there and easy enough right? Well yes, you're still required to run and keep reports at minimum quarterly and retain for a two year rolling period - and remember to have an individual(s) who is assigned the "authority to manage and promptly resolve questions on reports or inconsistencies between report contents, license entitlement, and the applicable license reporting tool". Better check that's been added to the appropriate JD's along the way. The new clause 10.2.(e), is somewhat favorable to the client in that it provides an avenue to address (with IBMs consent) deviations from the sub-capacity model, which in most cases would probably result from operating systems becoming non-eligible over time. What we (and others) have always attested to though is being solely reliant on one reporting tool, like ILMT, can prove very problematic in that where improperly configured you could easily be over-reporting and paying much more than you should - having an independent product (like ComplianceWare) is often the best - or only - way to reconcile outputs and ensure accuracy. so ... when does all this start?Well, basically now:

Employee for Java SE Universal Subscription: is defined as (i) all of Your full-time, part-time, temporary employees, and (ii) all of the full-time employees, part-time employees and temporary employees of Your agents, contractors, outsourcers, and consultants that support Your internal business operations. The quantity of the licenses required is determined by the number of Employees and not just the actual number of employees that use the Programs. For these Java SE Universal Subscription licenses, the licensed quantity purchased must, at a minimum, be equal to the number of Employees as of the effective date of Your order. Under this Employee metric for Java SE Universal Subscription Programs(s), You may only install and/or run the Java SE Universal Subscription Program(s) on up to 50,000 Processors, If Your use exceeds 50,000 Processors, exclusive of Processors installed and/or running on desktop and laptop computers, You must obtain an additional license from Oracle. Key points - Count all employees, not just users, and this includes those outside the organization that support your internal business operations! How many individuals might that definition capture in a large enterprise, if you can indeed identify and track them accurately at all !! Then you're facing a tiered per user monthly subscription cost (that reduces based on higher volumes, phew) that would see a shop of 500 Employees facing $7,500 per month in subs! So what are my Java options ...

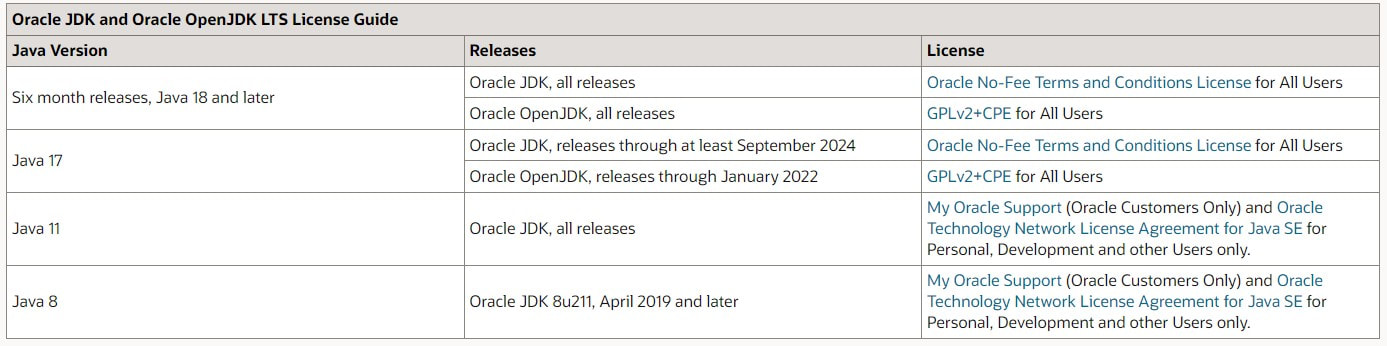

So lets look at the licensing currently available for Oracle Java SE releases:

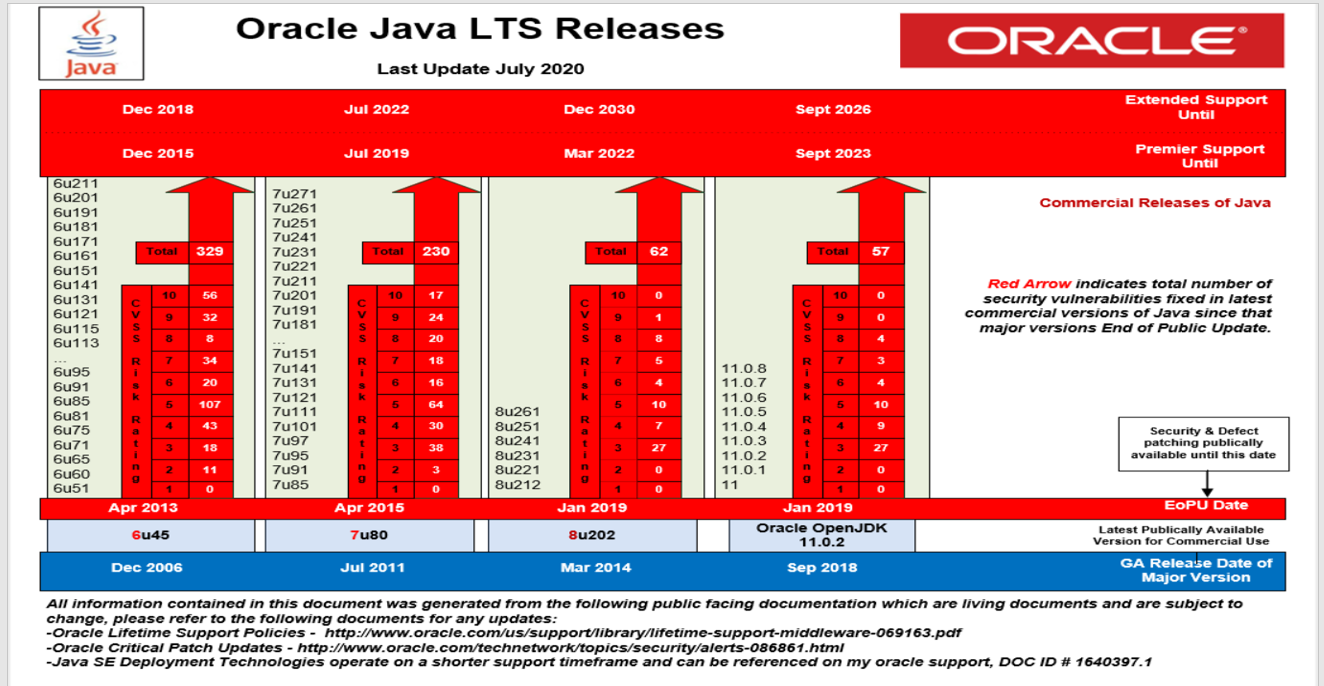

And how do the LTS and non-LTS releases co-exist?For product releases after Java SE 8, Oracle will designate only certain releases as Long-Term-Support (LTS) releases. Java SE 7, 8, 11 and 17 are LTS releases. Oracle intends to make future LTS releases every two years meaning the next planned LTS release is Java 21 in September 2023. For the purposes of Oracle Premier Support, non-LTS releases are considered a cumulative set of implementation enhancements of the most recent LTS release. Once a new feature release is made available, any previous non-LTS release will be considered superseded. For example, Java SE 9 was a non-LTS release and immediately superseded by Java SE 10 (also non-LTS), Java SE 10 in turn is immediately superseded by Java SE 11. Java SE 11 however is an LTS release, and therefore Oracle Customers will receive Oracle Premier Support and periodic update releases, even though Java SE 12 was released. This fundamentally raises some questions and no doubt financial concerns for many, so if you haven't done so already make sure you're across your Java landscape and can quantify not only future costs, but future efforts, and make the right decisions for how you want to continue with your Java developments and solutions.

Internal Audit Report highlights flaws in NASA's SAM Practices that many organizations will relate to.The OIG summary of their SAM audit says it all:

... with all of the above quantified in cost terms as:We estimate the Agency could have saved approximately $35 million ($20 million in fines and overpayments and $15 million in unused licenses) and moving forward could save $4 million over the next 3 years by implementing an enterprise-wide Software Asset Management program. All very compelling to implement improvements and progress NASA’s Software Asset Management from “basic” — the lowest of the four rating options in the Software Asset Management Maturity and Optimization Model developed by Microsoft — through the scale as per tiers and representations below:

The report is an insightful read for all SAM practitioners - and responsible management and executives - with clear language and succinct descriptions of the scope and challenges in the field of software asset management, and a pragmatic approach to the creation of an effective SAM Practice that applies to any size organization with a notable software inventory, not just those on the NASA scale. So, to the findings ...It was recommended that the Chief Information Officer: (1) establish enterprise-wide (institutional and mission) Software Asset Management policy and procedures; (2) implement a single Software Asset Management tool across the Agency; (3) align the Agency Software Manager position to report to the Agency Chief Information Officer; (4) establish formal legal representation and guidance for vendor software audits; (5) establish a software license awareness training ‘short course’ focusing on approvals, compliance, and other issues a general user might encounter; (6) implement a centralized repository for NASA’s internally developed software applications; and (7) develop an Agency-wide process for limiting privileged access to computer resources in accordance with the concept of least privilege. Additionally, to strengthen the financial aspects of NASA’s Software Asset Management it was recommended that the Chief Financial Officer: 8) implement a “penalty spend” classification in SAP to track license infractions and true-up payouts and 9) centralize software spending insights to include purchase cards. Nothing fresh there, just the usual (and often unheeded) advice.Unisphere Research, a division of Information Today, Inc., surveyed the readership of its Database Trends and Applications publication, which consisted of database managers, developers, CIOs, and IT directors. The survey, which sought views and experiences with software licensing and audits, was conducted in partnership with LicenseFortress gathering a total of 283 usable responses of which 155, or 69% of survey respondents, reported having been audited within the past three years, and 79% reported having been subject to a software audit within past five years. And the key findings? - the same fundamental approach and issues persist:

Lets take a closer look ...Interestingly, with all the hype and suggested benefits and advantages of moving to the cloud, close to 80% report that it has not changed their software compliance issues, or, in the case of 38% of respondents, it has increased compliance concerns. Only about one-fifth - 21% - say cloud has reduced their compliance issues. And even with close to half - 46% - reporting significant amounts of applications and data in the cloud (defined as greater than 25%), more than half of enterprises reported being audited by one or more software vendors! Similarly, audits themselves haven't changed much at all with 60% of respondents reporting their software audits lasting up to two months, 30% reporting audits lasting between three to six months, and 10% had audits extending more than six months into a year and beyond. The length of audits had 41% of smaller companies wrapping` up audits within a month, while half say the process lasted beyond three months, and 64% incurring additional charges for noncompliance. A substantial portion, 35%, had to pay $100,000 or more to achieve compliance with the vendor, while 10% saw $1 million or more in fees. So, in summary :Unsurprisingly, given the outcomes haven't essentially changed, the underlying good practice principles have also not changed - Software Asset Management is seen as critical to mitigating the impact of software audits by a significant share of respondents. Close to half, 44%, see SAM as essential to reducing the costs of their software, which is impacted by vendor audits. Another 41% cite the importance of SAM in avoiding compliance issues, with the leading choice being an internal software asset management/IT asset management (SAM/ITAM) team supported by SAM specific third-party tools. Disappointingly, it seems many respondents still remain reliant on vendor resources to support their audit. For some of the key underlying data click through the graphs below ...A slick new consolidated (and overdue) look for all IBM terms from one convenient site.

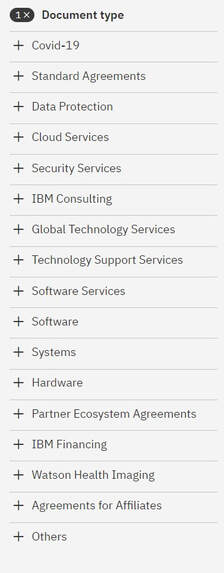

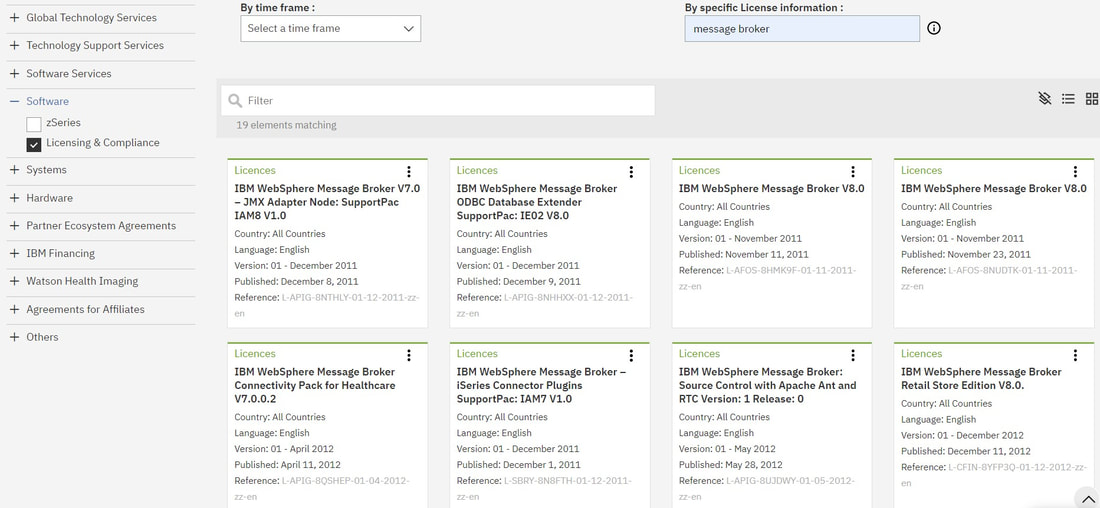

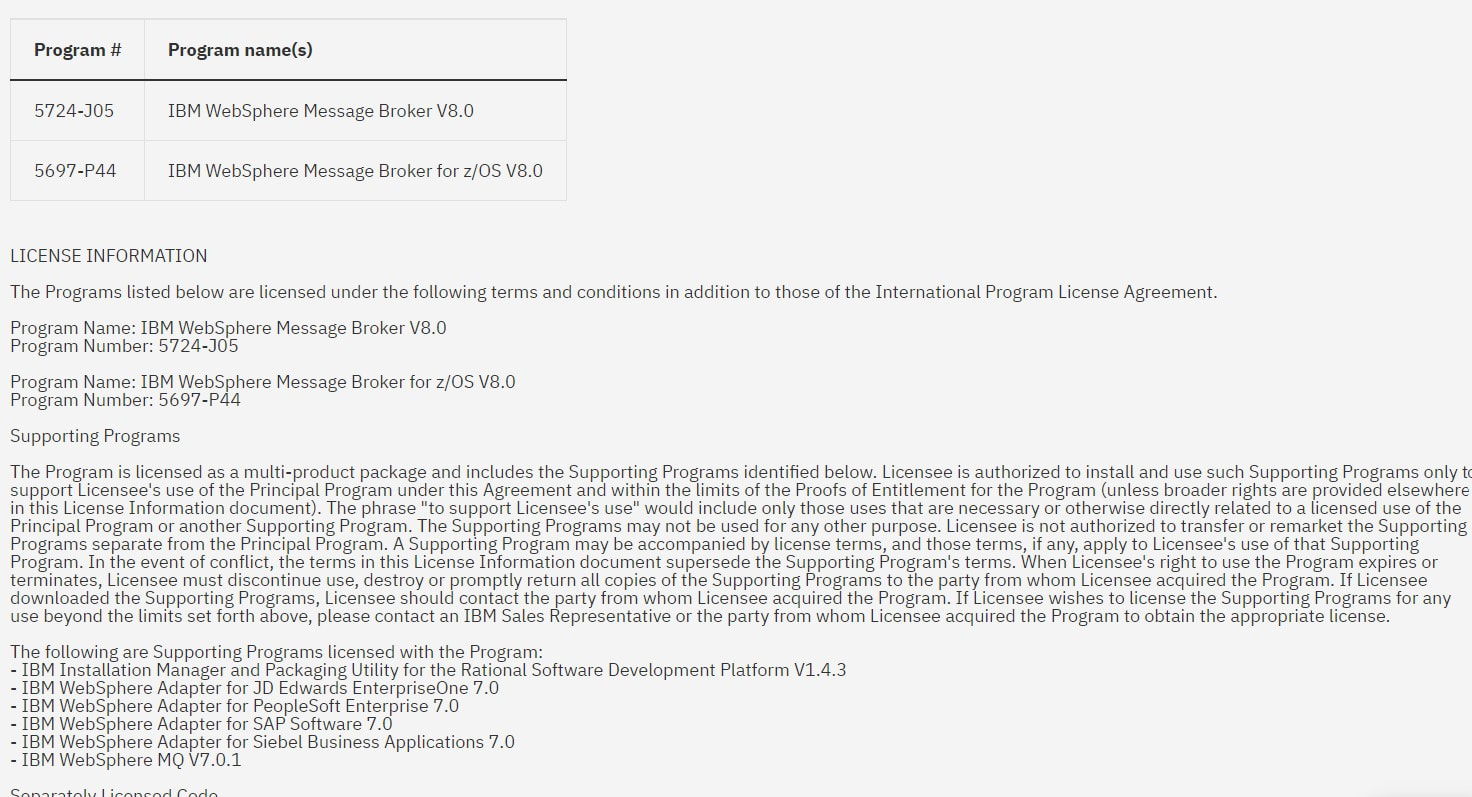

The Software license terms (all post May 1999) are searchable via the 'Licensing & Compliance' filter category, by time frame or license information (Program name/number, document form/part number, License Information (LI) number or License Information (LI) title): So nothing new or revolutionary on that front, however the ease of use and in particular the layout, share, download, and notification options provide all of the basic /requisite features you'll need - all in all, a welcome step forward from the IBM licensing team!

Firstly, lets take a look at the Terms of the Acquisition (all figures approximate)

... all very interesting, but what might it mean to us as customers?

So if you are a client of either Opentext or Micro Focus it would seem timely to review your licensing position in detail, ie. collect:

If you detect any discrepancies deal with them as a priority (remembering of course that there are likely footprints across your IT landscape over a good period of time), so remediate knowingly and accordingly. Also review your renewal dates and plans - if it falls into or around Q1/Q2 2023 it might serve well to request a renewal quote early to use as a comparison should the actual transaction occur under any new conditions or contracts. And as we've said before, keep an active watch on the Account Exec's/Managers you have with these two vendors - where changes are communicated it can be a pretty reliable indicator that there might be an audit letter in the post. So once again, a market shift that means its time to review, validate, confirm and ... prepare!

Oracle have announced the availability of a free License Manager tool to assist moves to OCI.While somewhat limited, the License Manager tool may well suit those organisations that don't run a full featured SAM system (such as ComplianceWare), and still need oversight across their OCI deployments.Currently, License Manager supports the following Oracle products and options:

It also provides some further capabilities such as apparently automating the license portability rules and API's that could prove useful for batch loads and integration with related systems, so if it might fill a gap in your SAM programme could well be worth a look.

A 'rapid move to subscription licensing' is telegraphed by Broadcom to expedite returns.It was only December when we wrote about 2022 potentially being the 'beginning of the end for perpetual licensing', and with Broadcom's announced acquisition of VMware we are surely seeing the telling signs. The transaction is expected to add approximately $8.5 billion of pro forma EBITDA from the acquisition within three years post-closing, which, as reported by the Register, is a significant undertaking given VMware currently produces about $4.7 billion. Their strategy to accomplish this? According to Tom Krause, president of the Broadcom Software Group, who stated on a Broadcom earnings call that they would embark on a “rapid transition from perpetual licenses to subscriptions.” and that can only mean one thing ...

Of course, there will be the usual designs on new customers etc, but fundamental growth can surely only come from the existing client base. The formula no doubt has been carefully crafted, planned for the coming months and years, and be executed slowly and purposefully renewal by renewal. As we know with any push to a subscription model the initial proposition will be quite compelling - savings on the spot! Existing investments in perpetual licenses will be recognised and applied! No wastage - pay only for what you use! No downside at all - wait hold on - you're adding consumption? That'll be at a different rate - its new workload after all. And the next renewal - well we've had to add some research and development investment there, as well as account for our additional operational costs, so yes, admittedly quite a jump there. However with CIO's and CTO's promoting the relentless move to cloud and subscription based platforms for the short term ROI, it'll be awhile before those 'would it be more cost effective to run this stuff in-house' questions emerge in the boardroom, and by then, the changes will be irreversible and well ... just too late. So we will watch with interest what else might develop over the year in this space, be it via M&A or just plain changes in vendor offerings and models. What does seem to be more and more clear though - perpetual licenses are indeed an endangered species.

A caution when relying on vendors to deliver projects with software installs.Many projects require the expertise of vendors to install, configure and productionize their software and systems, however as the client and end-consumer you need to be aware of what exactly is making its way into your environments. All too often following discovery we'll find unaccounted for vendor software, which typically after an onerous investigation is found to be remnants from the vendor-led project, anything from desktop clients to entire VM's, each of which can have dire compliance implications and cost. But "hold-on - we didn't install it - the vendor did" is the common response, however a quick pointer to the relevant contracts will soon expose that this does not offer any defense - the customer is always responsible for compliance, even if it is the very vendors software in question. At a more concerning level is when a vendor installs another vendors software - while this is not uncommon with the extent of partnerships and interoperability in the modern industry, it still needs to be clearly and formally covered, ideally contractually or by reference to the vendors right to distribute and use any IP they don't own. These artefacts need to be registered and retained in the event of an audit that questions your usage rights - in the worst case scenario if the vendor has breached another parties IP rights you too could end up subject to an infringement claim, and that's no place you want to be.

And never rely on the vendor's personal emails or assurances that 'all is well' - none of that will hold-up under audit (even if they are still there). When it comes to IP all bases need to be formally covered, and if that's proving to be a problem, well you might want to be even more wary.

Does your company distribute Adobe Reader to employees? ... if so, make sure you have a valid Distribution License.Now it's not as onerous as it sounds - it can all be done online, so lets look at some of the detail. When do I need it?A Distribution License Agreement is required for:

Note: You do not need to apply for a Reader Distribution License if you prefer to direct users from your website to Adobe.com to download Reader. What does the Agreement allow me to do?You will be authorised to:

What are the key restrictions?You must:

Ok, got it ... what do I do now?You'll need to apply for a desktop license which will take just a few minutes and is required to determine how you intend to use Reader. After you complete the short online form, you'll receive an email with a link to the installers. You'll also need to mark a renewal date 12 months from receipt to reapply - the agreement is only valid for one year.

The Software Landscape is now ripe for vendors to lock-in Subscriptions and eliminate what (to them) are much loathed Perpetual Licenses ...

So what could be done to solve their predicament - enter Subscription Software!

So make sure your cloud strategy includes a proper evaluation of licensing - ask where will I end-up following that journey from a commercial perspective? Everyone will say 'Better-off' ... but you might find in the long term that's not necessarily the case.The Software Freedom Conservancy sues Vizio, Inc. for alleged violations of the GNU GPL covering software incorporated into certain Vizio smart TVs.

An early and widely publicised example of the impacts of such non-compliance was the 2008 lawsuit initiated by the Free Software Foundation (FSF) against Cisco Systems that alleged several of Cisco's consumer network routers used GPL licensed code. The litigation was settled with Cisco releasing the source code, making a contribution to the FSF, and appointing a compliance officer. Quite the kicker. In this latest action SFC asserts that all consumers of copyleft code deserve the opportunity to know, access and modify the code on their devices and is seeking the release of the complete, corresponding source (CCS) for all GPL’d components on Vizio TVs. The benefit? Well much as it was with the older analogue hardware TV's that would be repaired by technicians, coders would have the option to repair the software when the supplier potentially stops support for their older models (surely not from 'built-in obsolescence'?) And lets not forget the ethics involved given the FOSS history and the principles that underpin it. From its fruition in the 1990s and early 2000s when Linux and other GPL’d software was considered nothing more than experimental. From those curious beginnings grew the community of enthusiastic developers whose software has benefited and furthered the rights and freedoms of individual users, consumers, and developers around the globe. It is a culture worth preserving and that means keeping organisations who benefit from that culture honest. (SFC refers to this as 'Ethical Technology' meaning technology that serves its users rather than the corporations who profit from it and preserves and promotes the rights of those impacted by it). So if you are an organisation using open-source software, and in particular, incorporating it in proprietary commercial products, make sure you understand your compliance obligations with the relevant open source licenses. If you don't, you might soon find that letter arrives requiring you to release all of the IP you've built on top of the most excellent Free and Open Source Software that we all benefit from. The Software Freedom Conservancy is a 501(c)(3) nonprofit organization that is supported largely by individuals who care about technology and advocates for software that has been designed to be shared (using copyright licensing that allows users to freely use and repair it, and, in particular, forms of software licensing that use the restrictions of copyright to promote sharing called “copyleft”, such as the GPL).

In the absence of strict procurement practices and robust record keeping its all to common to see organisations struggling to retrieve their records of purchase backing-up their claim to entitlements. In fact how often do we hear "yeah we've got 20 licenses for that - they're listed on Dave's spreadsheet". Now lets be clear - the fact that it's on Dave's, or Susan's or anyone's spreadsheet does not constitute evidential fact. For that, you'll need the Proof of Entitlement if issued by the vendor, or the (signed) Contract containing the license grant, or the Order issued under it for the products in question. At a minimum if those are lost in the tracks of time (no doubt residing only in someone's email who has long departed the employ of the company), you'll need the latest invoice that shows the products and quantities that were covered by the last payment (ie. either actual purchase or renewal). Again, its all too common that it's not until an audit that organisations are forced to scramble through the purchasing, legal, IT et al records looking for some artefact to substantiate the otherwise baseless right of use claim for the vast overage of licenses that have been deployed! This trek down memory lane can be the most time consuming - and often fruitless - use of specialized resources, the cost of which is not generally recognized by management and similarly overlooked in the justification of a dedicated SAM function. So what's the alternative? Quite simply a process that ensures those essential records are properly recorded in an organized and readily accessible system, and are kept current through routine and ongoing ownership - once established this is not as much of an overhead as it might seem, and having all of that data at hand when challenged by a vendor can go a long way in underlining your disciplined approach and credibility in such a way that you'll be last on the next audit round list, if in fact on their radar at all. Now this will no doubt rally those skeptics with their "wait - I just call my reseller and say give me a list of what we own" approach, and while this might offer some solace it doesn't necessarily constitute proof in the same way that last document of fact - the invoice - does. How's that? Well for one example think of step-up licenses that will be printed there for all to see, but what about the original license it is based on (and worse, what if that original license is actually still in use!), or those 'from-SA' uplifts that require unravelling potentially years of purchase history to properly determine entitlement. All best avoided by having a routine practice supported by a specialized system in the first place ...

As of 1st March 2022 all plans will increase anywhere from 8.5% to 20%Stating that it is the "first substantive pricing update" since its launch in 2011 Microsoft have announced uplifts to all of its Office 365 plans early next year, citing the addition of 24 apps to the suites —Microsoft Teams, Power Apps, Power BI, Power Automate, Stream, Planner, Visio, OneDrive, Yammer, and Whiteboard — and the release of over 1,400 new features and capabilities in the three key areas of Communication and collaboration, Security and compliance, and AI and automation as justification for the rise. As a sweetener they have also added unlimited dial-in capabilities for Microsoft Teams meetings across the enterprise, business, frontline, and government suites over the next few months, currently only available under the E5 plans. This will allow users to access Microsoft Teams meeting from virtually any device regardless of location when unable to access an internet connection. So what are the prices changes?Per User charges as of 1st March 2022 will be as follows:

So biggest increases to the lower cost plans, with the popular O365 E5 attracting the smallest hike. The increases will apply globally with local market adjustments for certain regions, and there are no changes to pricing for education and consumer products at this time. With Microsoft Teams being industries tool of choice lately the rise is unlikely to cause much of a stir in the marketplace, however worth leveraging your enterprise agreements and overall spend to get the best discounts available — larger orgainsations could be up for a hefty and no doubt unexpected budget blowout if they're unlucky enough to be renewing next year!

In this second part of our SAM Foundation series we look at Compliance Reporting and the importance of understanding your deployment position.In part one of this series we covered the importance of a full data collection across your data sources and contract and licensing information, now we look at how to bring that together into a compliance position. The first realisation is - wow! - that's a lot of data we have out there! So just as we needed tooling to perform the data gathering exercise we are going to need analytics to decipher not only what's important but how to interpret it all, for which there are two aspects:

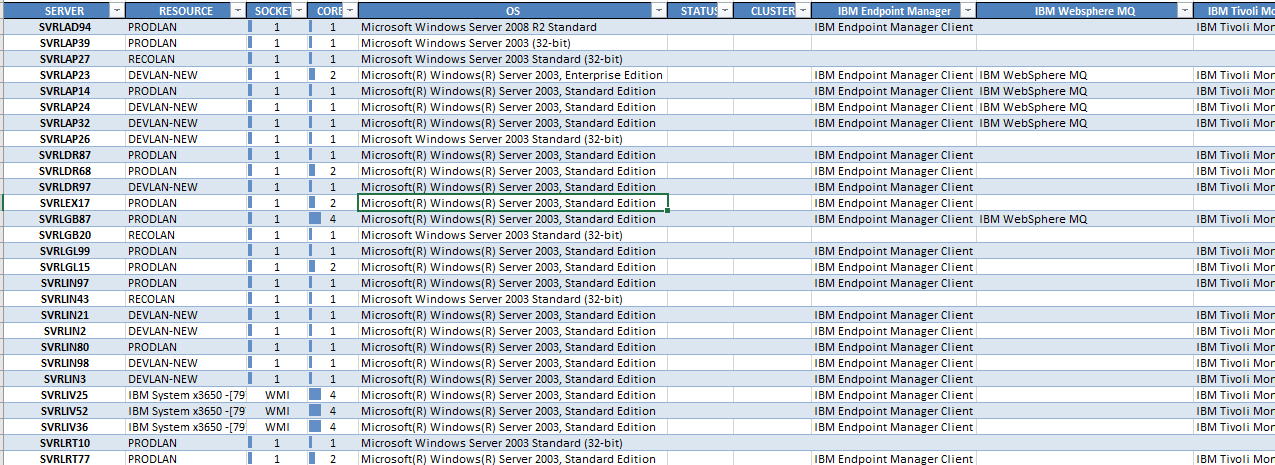

Now what exactly do we mean by 'Scale Reporting'? Basically this means a reporting facility that enables you to stipulate variable parameters from product to vendor to company, with the output organised by device in a concise and easily readable form - for example ComplianceWare's powerful python & pandas based analytics engine that slices and organises the data into output as a familiar Excel workbook. A snapshot of the output as below: The analytics should also consider base licensing metrics such as server core and PVU minimums, apply relevant bundling rules to avoid double counting, and recognise non-chargeable installations such as clients and free-edition software. So we now have our first view of what's deployed where - and that's a good start, but it doesn't mean the jobs done. You'll want to perform some spot / sanity checks across the report, and that's where the 'Direct Examination and Querying' comes in. Here, your tool should allow you to easily interrogate your data collection (which can span many millions of rows) for further review and confirmation, and that's accomplished via smart features that enable you to slice, limit and target the fields and items of interest. Again, with ComplianceWare as an example you can easily navigate through the data by vendor, product, data source, and perform smart searches with inclusion and exclusion parameters to dynamically find exactly what you are after. ok ... we're happy with our deployment report - now what?Now it gets interesting - does what's reported as deployed match what we're actually entitled to? While some products can be automatically tallied (eg. products with simple install or device metrics) others will require more effort such as resource based metrics like cores or logical licenses such as users, and those in more complex environments such as virtual environments where physical v virtual considerations must be taken into account. Here there are no short-cuts - it will require a knowledgeable individual (preferably with prior experience in the environment) to work through each product in a methodical and calculated manner to (a) derive the optimal licensing construct and then (b) reconcile against the recorded (and evidenced) level of licensing. As this progresses it is imperative to capture your findings and ensure they are lodged as an artefact for audit readiness and as a baseline for future reporting cycles (again with ComplianceWare this can be stored as 'Verification' material alongside the updating of actual usage figures). And just how often should the whole exercise be performed? We'd recommend that you cover your major vendors at least annually, and institute a program of work that targets a select number of products or vendors quarterly. The good news is that once you've completed one cycle others become easier as you'll have a baseline to compare or commence from. So to summarise:

In this series we'll cover the foundations of SAM, and what they mean.Data is the essence of SAM, much as it is with most of technology. It's all there, somewhere, amassed over time, stashed away in the recesses of the organisation. It may exist (hopefully) in electronic form, or (lamentably) physical records filed and stored, most typically both. So we know the data's out there, the question is how - and where - do we start? The first step is to determine what data sources you can tap into, from the raw systems themselves through other collection platforms you might run such as CrowdStrike, Microsofts SCCM, IBM's ILMT, HCL's Bigix Inventory etc. With larger organisations the issue is always completeness - be it running agents or agentless via remote extracts - how do we know we're capturing everything we should ... and that can be a much more difficult proposition than it seems. The approach is to source as much data as possible and compare it, merge it, blend it, and massage it to get the best quality information you can - the issue today is not so much sourcing the data, its how to filter through it to find what's important, and to do that you'll need tooling. That means firstly figuring out what is most workable - and also most repeatable. This could be as simple as providing system logins to run application specific extracts, or remote connectivity as a centralised administrator, or even integrated access via API's. All act as feeds to your SAM system that will then do the hard data crunching and reporting work for you (for which ComplianceWare's pandas driven analytics engine is purposely designed). So that covers the inventory side of things - collecting the deployment information and associated identifiers (ie. the editions, statistics, capacities etc) necessary to derive your consumption levels, but then you'll need the associated Contracts and Licensing material as well to compare to your entitlements and establish your compliance position, and that's where things can get tricky. Most organisations - even those that are largely centralised - have some degree of local procurement (all the way down to problematic credit-card purchases) that make it difficult to collate the full and complete record of ownership. So you'll need to start with what is known, match that to the inventory you have identified exposing the shortfalls and gaps, and go looking for those great unknowns. This can be a long and even fruitless exercise at times, sometimes reliant purely on the knowledge of individuals (if they're still with the organisation that is), extending from business to technology teams, from legal to procurement, all depending on how controlled and robust the procurement processes are. The key here is to capture that information so its recorded and available from there on, and the whole exercise doesn't have to be repeated (as it would in the case of audits). Ideally your SAM system then allows you to maintain that connection of inventory to entitlements, organised by the contracts they were acquired (and operate) under. Any compliance issues can then be dealt with in a managed and controlled way, along with the potential benefit of savings from license consolidation, decommissioning, harvesting, or reuse, but we'll cover that in Series (#2). And the kick - data collection isn't a one-off, its an ongoing process that should be repeated as often as necessary based on the frequency and fluidity of change in your environment. On the plus side, once you have established the process it becomes much easier and efficient to rerun, and depending on your SAM system gain more intelligence each time (for example, ComplianceWare can compare different data captures and report the differences so that you can quickly identify what's changed, and what might need attention). Key takeaways then are:

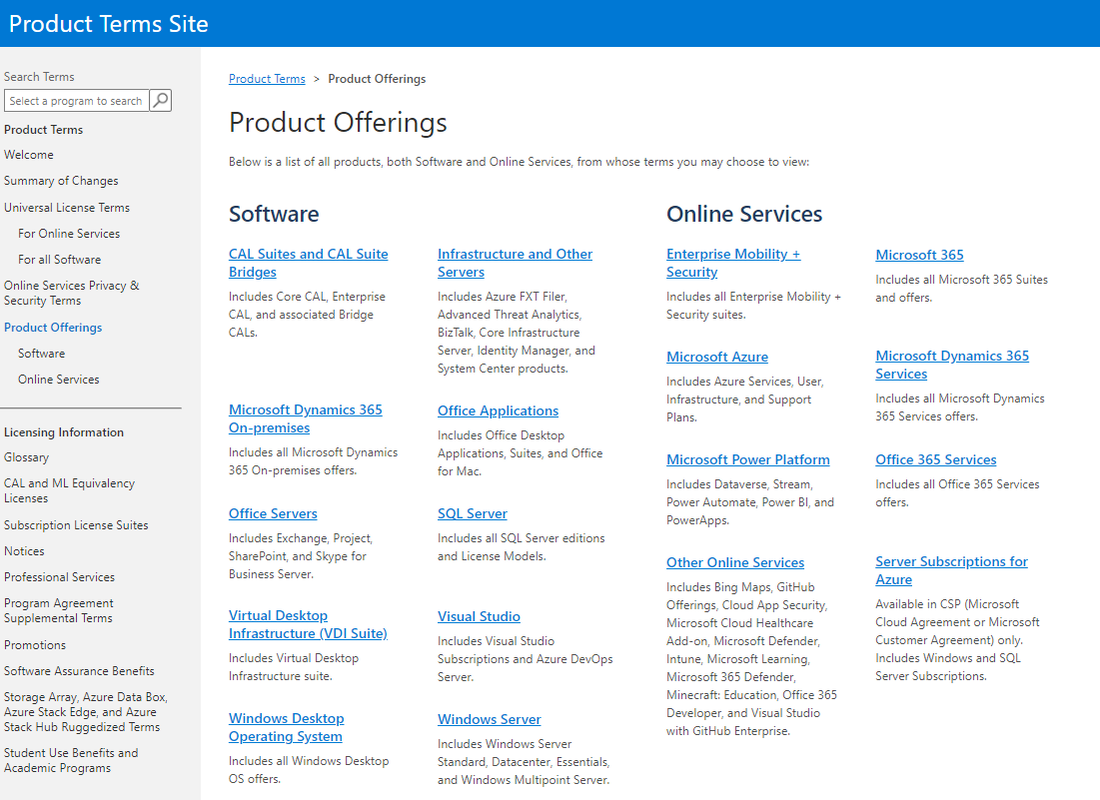

Keep in touch for the upcoming SAM Foundation Series (#2) - Compliance Reporting.The February 2021 edition of Microsofts Product Terms Document will be the last.A little under two years ago we reviewed Microsofts new approach to licensing terms in our June 2019 blog here - now its being further revamped. As announced on the front page of the February PT document: Please note this is the last Product Terms Word document. Going forward, the terms will be published on the Product Terms site available at https://www.microsoft.com/licensing/terms/productoffering. Archived versions will continue to be available. For more details, go to https://www.microsoft.com/Licensing/product-licensing/products. What does it look like - the landing page as shown below: So quite clear and compact, although you will need to be quite savvy with their license programs and models to get the most out of using it. ... and when put to the test?We decided to take on one of their more convoluted product licensing models - Power BI - and, well, it didn't seem any simpler. With prerequisites like "Power Automate per user with attended RPA plan, or Power Automate per flow plan" (ok...), and Extended Use Rights such as "Power Apps Portals that map to licensed Dynamics 365 application context and, Power Apps Portals that map to the same environment as the licensed Dynamics 365 application" (right...), the format might have changed but the content is still not that intuitive is it? So while access to dynamic and current licensing information is always a good thing, simpler licensing models and metrics would we think resonate much better with software customers in general. After all, we all want to be compliant, so why make it so hard we wonder - any thoughts / comments ?$$?

A year of challenges and differences to all (recent) others.Perhaps not surprisingly the IT industry did its part in the battle with Covid-19. Mobility became essential - workers were confined to homes, offices were shutdown, usual communication and interactions were stifled. ... enter video conferencing on a whole new levelFrom Zoom, to WebEx, to Teams everyone had to find a way to adapt. Not only did meeting online become the norm for but also the stand-in for the social watercooler or coffee break gatherings, or even the swell of welcomes and farewells. That all worked well and is undoubtedly with us for good. But what about licensing? If you recall our March Blog we called out the possibility of easily becoming non-compliant in the rush to stay connected to your workforce and customers. With the new year imminent its now time to regroup and review. Are all of those rapid changes squared off? Have you reconciled usage to entitlements? Or are you perhaps uncertain of exactly what state you have now found yourself in? Be particularly concerned if you used the likes of Citrix to enable access to desktop applications - if unconstrained you could be liable for all potential usage, not just actual usage. Or if you inadvertently permitted a level of multiplexing by routing traffic or enabling access at the simplest level (think generic logons, or joint application connections) you'd best tidy things up. Don't be complacent thinking there has got to be some vendor leniency out there - we are already aware of audits being undertaken - there is no compromise when revenue is at stake. So as always, take stock of your situation - get on top of your compliance position and be ready to assert your view rather than just accept what state your vendor tells you you're in. ... and if you need help to do so, just contact us

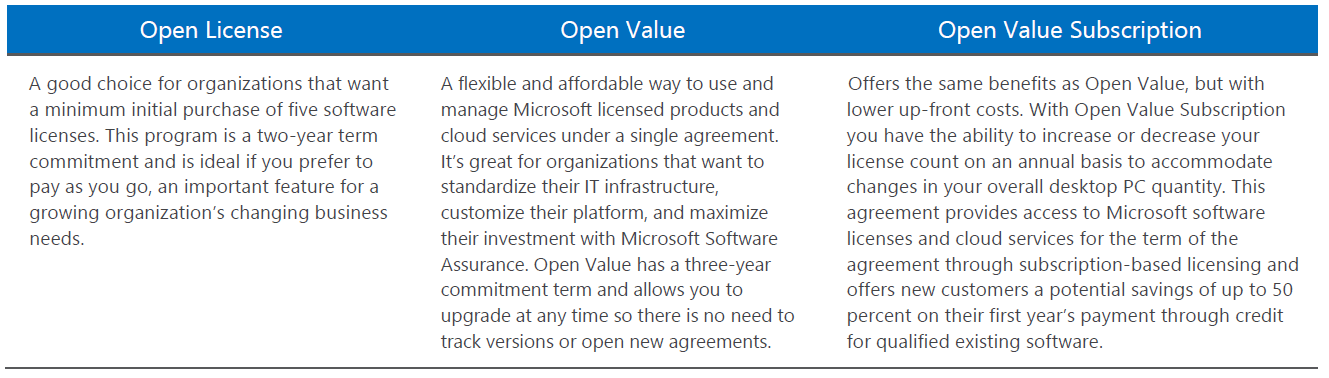

What do you need to do?All services, products, and offers in Open License program today will remain available until January 1, 2022. To plan for future purchases, ask the partner you’re currently buying software licenses from about your options. Your partner can help you decide the best steps for you, whether that’s new licenses or online services subscriptions. If you don't have one, you can Find a Microsoft partner. Are there any other options available?Yes - depending on what you want to purchase you can make use of the Open Value or the Open Value Subscription program:

Here's a reminder of the differences between the current programs: So nothing alarming in this announcement, more just an evolution of a 20 year old program to align with Microsofts contemporary go to market structures. While 2022 might seem some time away you can be sure the changes will begin to emerge through 2021, so just something more to be aware of and prepare for in the ever changing world of software licensing!

So, what has the uptake of Java SE Subscriptions been like?There have been regular communications from Oracle promoting the value of their Java SE subscription service since version 8 went end-of-public-update (EoPU) in January 2019, but what has the uptake actually been like? The latest (July 2020) statistics have been published as below, with 57 vulnerabilities reported since the EoPU of Java 11, with 7 attaining a CVSS (Common Vulnerability Scoring System) of 7 or more (reflected below). The question being, is that enough of a concern to pick up the phone and make the call to your Java Business Rep? A reasonable question, and one for which we don't have a definite answer. Anecdotally, the view would be not generally, however this is unsubstantiated so we'd be keen to get a view from the industry - please take the time to complete our quick 2 question poll below: Thanks for taking the time to contribute - we'll publish the results soon!

Data Recovery Environments using Copying, Synchronizing or Mirroring Standby and Remote Mirroring are commonly used terms to describe these methods of deploying Data Recovery environments. In these Data Recovery deployments, the data, and optionally the Oracle binaries, are copied to another storage device. In these Data Recovery deployments all Oracle programs that are installed and/or running must be licensed per standard policies documented in the Oracle Licensing and Services Agreement (OLSA). This includes installing Oracle programs on the DR server(s) to test the DR scenario. Licensing metrics and program options on Production and Data Recovery/Secondary servers must match. Servers – Disaster Recovery Rights: For each Instance of eligible server software Customer runs in a Physical OSE or Virtual OSE on a Licensed Server, it may temporarily run a backup Instance in a Physical OSE or Virtual OSE on either, another one of its Servers dedicated to disaster recovery, or, for Instances of eligible software other than Windows Server, on Microsoft Azure Services, provided the backup Instance is managed by Azure Site Recovery to Azure. The License Terms for the software and limitations apply to Customer’s use of the backup Instance. If its not specifically called out in the VMware Product Guide it will need licensing, and that means everything other than Continuent and vRelaise for Log Insight. Surprisingly, VMware deem an install to be 'use' of the software - yep - just binaries sitting on a disk. RHEL Linux Subscription Guide: Cold backups: The server has software installed and configured, but it is turned off until the disaster occurs or for periodic disaster recovery procedure tests. For Red Hat Enterprise Linux, this means that the customer is allowed to preload the bits as a courtesy. However, Red Hat Content Delivery Network cannot be used to update the system until the disaster happens. Then, the paid subscription on the failed machine transfers to the cold backup sever. In this case, a customer does not need two subscriptions. The customer will consume only one subscription at any point in time. Red Hat will allow the customer to pre-provision the software bits onto the cold backup machine as a courtesy. If a customer is found to be running more units of Red Hat Enterprise Linux than the customer has subscribed for because the customer has found a use for these pre-provisioned servers other than this cold backup use case, the customer is obligated to pay Red Hat. Backup Use Defined: For programs running or resident on backup machines, IBM defines 3 types of situations: “cold”; “warm”; and “hot”. In the “cold” and “warm” situations, a separate license for the backup copy is normally not required, no additional charge applies, and IBM does not need to be notified. In a “hot” backup situation, the customer needs to acquire another license. All programs running in backup mode must be under the customer’s control, even if running at another enterprise’s location.

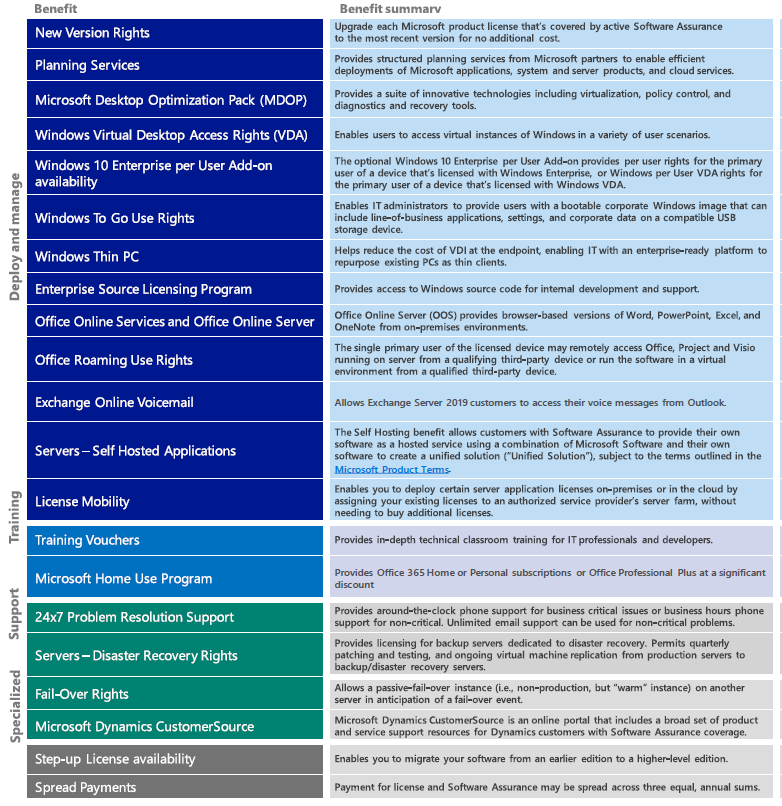

New for 2020 - Microsoft to reduce Software Assurance BenefitsChanges to Microsoft's SA Benefits have been announced effective 1st February 2020 which will see the end of some of the most useful aspects of the program, in summary:

So time to review all of your enrollments and make sure you convert all of your SA Benefits to get full value out of your investment in these programs. As a refresher, take a look through the list below.

|

<

>

Archives

November 2023

|

|

Unravelling license complexity for Business

ACN 623 529 751 |

Privacy Policy | Terms of Use

|